GCR ACCOUNT ANNUAL MAINTENANCE FEES

According to Joint Ministerial Decision no. 79752/30-12-2014 (Government Gazette 3623/31-12-2014/TB) which was issued according to article 8 of Law 3419/2005, as in force, the GCR maintenance account fee was set, which is uniform for all GCR services per category and legal form of liable person:

| LEGAL FORM | ANNUAL ACCOUNT MAINTENANCE FEE (in euro) |

| Public Limited Companies | 320 |

| Branches of Foreign Public Limited Companies | 300 |

| European Economic Interest Groupings | 300 |

| European Company (SE) | 300 |

| European Cooperative Society | 300 |

| Limited Liability Company | 150 |

| Branches of Foreign Limited Liability Companies | 150 |

| Limited Liability Cooperatives | 100 |

| Private Company | 100 |

| Personal Companies (Unlimited and Limited Partnerships) | 80 |

| Branches of Foreign Personal Companies (Unlimited and Limited Partnerships) | 80 |

| Individual Businesses | 30 |

| Branches of Domestic Companies | 1/4 of the relevant fee per legal form |

| Civil Law Companies under article 784 of the Civil Code | 100 |

| Joint Ventures | 100 |

| Others registered optionally with GCR | 20 |

These fees are payable within the first quarter of each year for those already registered with GCR, as for new liable persons by the end of the calendar year of setting up, either by credit or debit card, or by electronic deposit into a K.E.E.E. (Union of Hellenic Chambers) bank account, or through online banking services, as those alternatives are disclosed and available on the GCR website(www.businessportal.gr).

For your convenience, here are the channels of service provided:

- PIRAEUS BANK with immediate payment update:

- PAYMENT AT THE CHAMBER: to the debit of a cash account

- PAYMENT AT THE CHAMBER: with cash at the counter

- WINBANK INTERNET BANKING PAYMENT: to the debit of a cash account, Group credit card

- WINBANK PHONE BANKING PAYMENT: to the debit of a cash account, Group credit card

- PAYMENT AT WWW.EASYPAY.GR : to the debit of a cash account, Group credit card

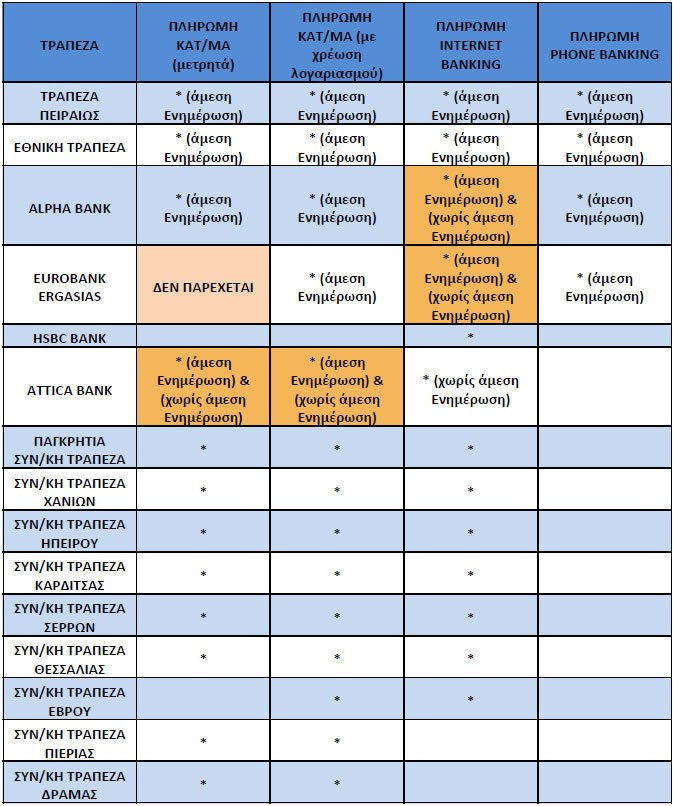

- Payment via OTHER BANKS, is available as shown in the Table below:

Only for payment problem issues such as:

- Payments not passed

- Payments rejected by the Bank

- Double payments contact the Central GCR Service at the Central Chambers Union + 30 2103392440.

If a liable person fails to pay such fees within the prescribed deadlines and has not been erased by GCR, the fees shall be sent by the competent GCR service of the relevant Chamber to the Tax Administration for confirmation and collection, in accordance with the provisions of the Code for the Collection of Debts owed to the State (KEDE).

The obligation of businesses and of Chambers is mandatory by law and refers to the GCR account fees, which have not been paid until the end of year preceding the current one.